Understanding Portfolio Theory: A Comprehensive Guide

In the complex world of finance, creating an optimized investment portfolio can be a daunting task. The good news? Portfolio theory offers a structured approach to help you achieve this goal. This guide dives deep into the core concepts of portfolio theory, exploring its significance and how it can benefit traders, investors, technologists, and professionals. Whether you're a seasoned investor or just starting out, this comprehensive guide will enhance your understanding and application of portfolio theory.

Why Portfolio Theory Matters

Portfolio theory is a critical concept for anyone involved in financial markets. It provides a framework for constructing portfolios that maximize returns while minimizing risk. For traders and investors, leveraging portfolio theory can lead to more informed and strategic investment decisions. Technologists can use it to develop advanced financial models and tools, while professionals in finance can enhance their advisory services.

StocksPhi is at the forefront of helping individuals and institutions implement portfolio theory effectively. Our expertise in portfolio management and financial services ensures that our clients can achieve optimal portfolio diversification and risk management. Whether you're looking to diversify your investments or optimize your returns, StocksPhi has the tools and expertise to guide you every step of the way.

What is Portfolio Theory?

Portfolio theory, developed by Harry Markowitz in the 1950s, revolutionized the way we think about investments. At its core, portfolio theory provides a mathematical framework for assembling a portfolio of assets that maximizes expected return for a given level of risk. This theory relies on the idea that risk-averse investors can construct portfolios to optimize or maximize expected return based on a given level of market risk.

Key principles of portfolio theory include:

Portfolio theory has profoundly influenced financial thinking and investment practices, making it a cornerstone of modern finance.

Core Concepts of Portfolio Theory

Understanding these core concepts is crucial for anyone looking to optimize their investment strategy. StocksPhi offers tools and insights that help investors navigate these principles effectively, ensuring that their portfolios are both diverse and efficient.

1.1: Understanding the Capital Market Line (CML)

The Capital Market Line (CML) is a crucial concept in portfolio theory that extends the efficient frontier into the realm of capital market equilibrium. The CML represents portfolios that optimally combine risk-free assets and the market portfolio, showcasing the best risk-return combinations available.

1.2: Key Features of the CML

1.3: CML vs. Efficient Frontier

While the efficient frontier only includes portfolios of risky assets, the CML includes combinations of a risk-free asset and the market portfolio. This distinction is significant for investors looking to balance their portfolios with risk-free assets to achieve a desired risk-return profile.

1.4: Practical Applications of the CML

StocksPhi empowers investors with tools and expertise to leverage the CML in constructing balanced and efficient portfolios. By integrating risk-free assets with the market portfolio, StocksPhi ensures that your investments achieve the best possible risk-adjusted returns.

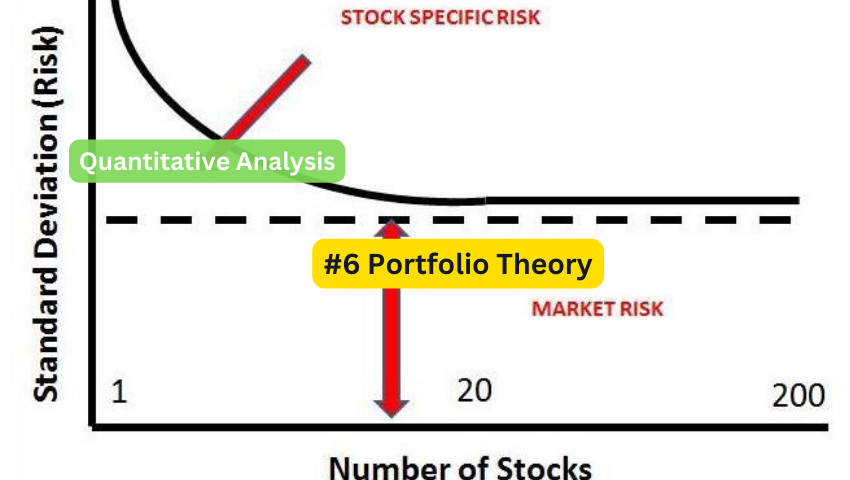

2.1: Understanding Diversification

Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The rationale behind this technique is that a diversified portfolio will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio. Diversification is possibly the most essential concept within portfolio theory.

2.2: Types of Diversification

2.3: Practical Examples of Diversification

Let's consider an example: If you invest all your money in a single technology stock, your portfolio's performance is entirely dependent on that one company. If the company performs well, you gain; if it doesn't, you lose significantly. However, if you spread your investments across multiple technology stocks, healthcare stocks, bonds, and perhaps some real estate, the risk associated with one poor-performing investment is cushioned by the others.

StocksPhi specializes in helping investors achieve optimal diversification. Our advanced analytics and personalized advisory services ensure that your portfolio is balanced across various asset classes, geographic regions, and industries, thus minimizing risk and maximizing potential returns.

3.1: The Efficient Frontier Explained

The efficient frontier is a key concept in portfolio theory, representing a set of optimal portfolios that offer the highest expected return for a defined level of risk. Introduced by Harry Markowitz, this graphical representation helps investors understand the trade-off between risk and return and identify portfolios that achieve the best possible outcomes.

3.2: Constructing the Efficient Frontier

To construct the efficient frontier, one must:

Portfolios below the efficient frontier are sub-optimal because they do not offer enough return for their level of risk. Conversely, points above the curve are unattainable.

3.3: Practical Applications of the Efficient Frontier

StocksPhi utilizes advanced algorithms and data analytics to help clients construct portfolios that align with the efficient frontier. This ensures that your investments are not only diversified but also optimized for maximum returns at your preferred risk level.

4.1: What is Modern Portfolio Theory (MPT)?

Modern Portfolio Theory (MPT) builds upon the foundational concepts of portfolio theory, providing a comprehensive framework for constructing and managing investment portfolios. Developed by Harry Markowitz, MPT emphasizes the importance of diversification and the efficient frontier in optimizing portfolios.

4.2: Core Principles of MPT

4.3: Advantages of MPT

4.4: Criticisms and Limitations of MPT

While MPT offers numerous benefits, it also faces some criticisms:

Despite these limitations, MPT remains a cornerstone of modern financial theory and practice. StocksPhi integrates the principles of MPT with advanced analytics and personalized strategies to help clients achieve their financial goals.

Portfolio theory provides a robust framework for constructing and managing investment portfolios. By understanding and applying key concepts such as diversification, the efficient frontier, the Capital Market Line (CML), and Modern Portfolio Theory (MPT), investors can optimize their portfolios to achieve their financial goals.

StocksPhi stands out as a leader in helping investors apply these principles effectively. With advanced tools, personalized advice, and a commitment to excellence, StocksPhi ensures that your investments are well-positioned for success.