Imagine a trader who struggled to keep up with the fast-paced and ever-changing stock market. Despite his best efforts, he found his self constantly losing money due to emotional decisions and missing out on crucial market patterns. That was until he discovered Stocksphi's Convolutional Neural Networks (CNN) algorithmic trading system. Almost overnight, he saw a significant improvement in his trading results, thanks to the advanced pattern recognition and predictive accuracy of CNNs.

In today's competitive trading environment, algorithmic trading has become essential for both novice and professional traders. With the rise of artificial intelligence and machine learning, algorithms like those developed by Stocksphi are revolutionizing how trading is conducted. This blog post will delve into how Stocksphi's Convolutional Neural Networks (CNN) algorithmic trading works and explore its potential to enhance trading outcomes.

Convolutional Neural Networks, commonly known as CNNs, are a class of deep learning algorithms specifically designed to process structured grid data, such as images. Introduced by Yann LeCun in the late 1980s, CNNs have since become a cornerstone of machine learning, particularly in image and video recognition, natural language processing, and even financial market analysis.

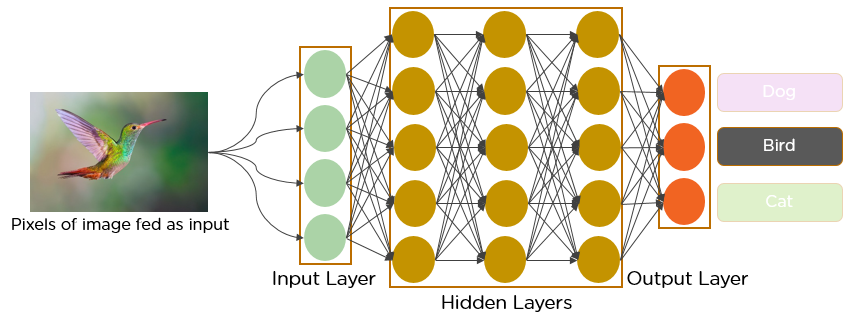

CNNs are inspired by the human visual system. They consist of multiple layers that automatically and adaptively learn spatial hierarchies of features from input data. These layers include convolutional layers, pooling layers, and fully connected layers, each playing a crucial role in the data processing pipeline.

At the heart of CNNs are the convolutional layers, which apply a series of filters to the input data. These filters slide across the data, performing convolutions to detect various features, such as edges, textures, and shapes. The pooling layers then down-sample the feature maps, reducing their dimensionality while retaining the most critical information. Finally, the fully connected layers perform high-level reasoning based on the detected features to make predictions or classifications.

Here's a simplified breakdown of the CNN architecture:

Applications of CNNs Beyond Trading

While CNNs are highly effective in algorithmic trading, their applications extend far beyond financial markets. For example, CNNs are extensively used in:

The versatility of CNNs makes them an invaluable tool in various industries, highlighting their potential to transform traditional practices through advanced data analysis and pattern recognition.

What Sets Stocksphi’s CNN Algorithm Apart?

Stocksphi has leveraged the power of CNNs to develop a cutting-edge algorithmic trading system that stands out in several ways. Unlike traditional trading algorithms that rely heavily on predefined rules and historical data, Stocksphi's CNN algorithm adapts and learns from vast amounts of market data in real-time. This adaptability allows it to detect complex patterns and trends that might be invisible to human traders or simpler algorithms.

Some key features of Stocksphi’s CNN algorithm include:

How Does Stocksphi’s CNN Algorithm Process Data?

Stocksphi’s CNN algorithm begins with data collection, gathering information from various financial markets, including stock prices, trading volumes, and economic indicators. This raw data undergoes preprocessing to remove noise and normalize values, ensuring the CNN can effectively learn from it.

Once preprocessed, the data is fed into the CNN, which processes it through several layers:

This multi-layered approach allows the CNN to identify intricate market dynamics and make informed trading decisions that maximize returns and minimize risks.

Training Stocksphi's CNN algorithm involves feeding it vast amounts of historical market data and allowing it to learn from past trends and outcomes. The algorithm uses techniques like backpropagation and gradient descent to optimize its performance, adjusting the weights and biases in its layers to minimize prediction errors.

To ensure the algorithm remains effective, Stocksphi continually monitors its performance and retrains it with new data. This ongoing optimization process helps the CNN adapt to changing market conditions, maintaining its accuracy and reliability over time.

One of the primary advantages of using Stocksphi’s CNN algorithm is its ability to recognize complex patterns in market data. Unlike human traders who might overlook subtle trends, CNNs can detect intricate patterns that indicate potential trading opportunities. This enhanced pattern recognition capability allows traders to capitalize on market movements that others might miss.

Stocksphi’s CNN algorithm significantly improves prediction accuracy compared to traditional methods. By analyzing vast amounts of data and learning from historical trends, the CNN can make more precise forecasts about future market movements. For instance, backtests and real-world case studies have shown that Stocksphi's algorithm consistently outperforms human traders and other automated systems in terms of prediction accuracy.

Emotional bias is a common pitfall for traders, leading to irrational decisions based on fear or greed. Stocksphi’s CNN algorithm eliminates this issue by making data-driven decisions free from emotional influence. As a result, traders can rely on the algorithm to execute trades based on objective analysis, leading to more consistent and profitable outcomes.

Day traders can greatly benefit from Stocksphi’s CNN algorithm, as it excels at identifying short-term market trends and generating timely trading signals. For example, a day trader using Stocksphi's algorithm reported a 30% increase in daily profits due to the algorithm's ability to swiftly adapt to intraday market fluctuations and execute high-frequency trades with precision.

Long-term investors can also leverage Stocksphi’s CNN algorithm to enhance their investment strategies. By analyzing long-term trends and market cycles, the algorithm helps investors make informed decisions about buying and holding assets. Success stories from long-term investors using Stocksphi reveal substantial portfolio growth and reduced drawdowns, demonstrating the algorithm's effectiveness in long-term investment scenarios.

Risk management is crucial in trading, and Stocksphi’s CNN algorithm provides robust tools for assessing and mitigating risks. The algorithm continuously monitors market conditions and adjusts trading strategies to minimize exposure to adverse movements. For example, during a market downturn, Stocksphi's algorithm can quickly shift to a defensive strategy, preserving capital and preventing significant losses.

Implementing CNN algorithms in trading comes with technical challenges, such as ensuring data quality, managing computational resources, and maintaining model performance. Stocksphi addresses these challenges by employing sophisticated data cleaning techniques, utilizing high-performance computing infrastructure, and regularly updating the algorithm to incorporate the latest advancements in CNN technology.

Market volatility can impact the performance of CNN algorithms. Stocksphi’s algorithm is designed to handle volatility by continuously learning from market data and adapting its strategies accordingly. However, traders should be aware that no algorithm is infallible, and maintaining a diversified portfolio is essential to mitigate risks associated with market fluctuations.

Algorithmic trading, including the use of CNNs, raises ethical and regulatory concerns. Stocksphi adheres to strict ethical standards and complies with all relevant regulations to ensure fair and transparent trading practices. Traders using Stocksphi’s algorithm can trust that their activities align with industry best practices and regulatory requirements.

To get the most out of Stocksphi’s CNN algorithm, consider the following tips:

In summary, Stocksphi's Convolutional Neural Networks (CNN) algorithmic trading system offers a powerful tool for traders seeking to improve their results. By leveraging advanced pattern recognition, enhanced