In this article, we'll dive into Conditional Value at Risk (CVaR), explaining its calculation, applications, and significance in managing risk. Whether you're a trader, investor, learner, technologist, or professional, mastering CVaR can enhance your decision-making process and safeguard your investments. StocksPhi, with its expertise in financial risk management, can help you navigate the complexities of CVaR and integrate it into your trading strategies effectively.

Conditional Value at Risk (CVaR) is a risk assessment metric that estimates the expected loss of an investment or portfolio in the worst-case scenario beyond a specified confidence level. Unlike Value at Risk (VaR), which provides a threshold value of potential losses, CVaR focuses on the tail end of the loss distribution, offering a more comprehensive risk evaluation.

CVaR is crucial for several reasons:

While both VaR and CVaR are used to measure financial risk, they have distinct differences:

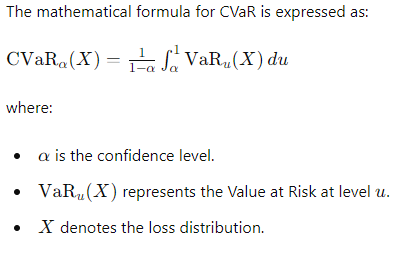

Calculating CVaR involves complex statistical methods that focus on the tail end of the loss distribution. The process starts with determining the Value at Risk (VaR) and then calculates the average of losses exceeding this VaR. Here’s a step-by-step breakdown of how CVaR is computed:

To illustrate, let’s assume we have a portfolio with the following potential losses (in millions):

[1,2,3,4,5,6,7,8,9,10]

Determine CVaR: Calculate the average of losses exceeding $9 million (i.e., $10 million).

Thus, the CVaR at 90% confidence level is:

A graphical representation can further clarify the concept. Below is a hypothetical loss distribution curve:

In this chart:

One of the primary applications of CVaR in finance is portfolio optimization. Traditional portfolio optimization methods often rely on minimizing variance or maximizing returns. However, they may not adequately address the risks associated with extreme market movements. CVaR provides a more comprehensive risk assessment by focusing on the tail end of the distribution of returns, thus helping investors create portfolios that are not only optimized for return but also for managing potential severe losses.

In risk management, CVaR is used to assess and mitigate potential losses that exceed the typical market fluctuations. Financial institutions, such as banks and insurance companies, use CVaR to measure and control their exposure to extreme market events.

Regulatory bodies often mandate the use of robust risk management techniques, including CVaR, to ensure financial stability. For example, the Basel III framework for banking supervision includes guidelines that encourage the use of CVaR for measuring market risk.

Under Basel III, banks must hold capital against their market risk exposures. CVaR provides a more accurate measure of these exposures compared to traditional methods. By using CVaR, banks can ensure they meet regulatory capital requirements while optimizing their risk management practices. StocksPhi’s compliance tools help financial institutions stay ahead of regulatory changes and implement best practices in risk management.

Investors and fund managers use CVaR to evaluate the performance of their portfolios relative to the risk taken. By incorporating CVaR into performance metrics, they gain insights into how well their investment strategies perform under adverse conditions.

R: A powerful statistical software widely used for risk management. It has several packages such as PerformanceAnalytics and RiskMetrics that can calculate CVaR. R's flexibility and extensive library make it a favorite among financial analysts.

Python: With libraries like QuantLib and PyPortfolioOpt, Python is another popular choice for CVaR calculations. Python's robust data manipulation capabilities and user-friendly syntax make it accessible for both beginners and experts.

MATLAB: Known for its advanced mathematical and statistical functions, MATLAB provides tools specifically designed for financial risk management, including CVaR. Its Risk Management Toolbox offers functions to measure and analyze market risk.

Excel: Although not as sophisticated as R or Python, Excel remains a widely used tool due to its accessibility and ease of use. Add-ons like XLSTAT or custom-built VBA scripts can help in calculating CVaR.

StocksPhi: Specialized financial analysis platforms like StocksPhi offer comprehensive risk management tools, including CVaR calculations. StocksPhi’s services are tailored to help traders and investors effectively manage their portfolios by providing detailed risk assessments and analytics.

When choosing a tool for CVaR calculation, consider these key features for accuracy and ease of use:

Risk management is evolving with technological advances and new regulations. Key future trends in CVaR include:

Conditional Value at Risk (CVaR) is a critical mathematical tool in financial risk management. It provides a deeper understanding of potential losses by estimating the average loss beyond the Value at Risk (VaR) threshold. Advanced software tools and evolving methodologies enhance the accuracy and relevance of CVaR calculations. By integrating CVaR into their risk assessment frameworks, financial professionals can make more informed decisions, leveraging robust mathematical models to safeguard against extreme market conditions. StocksPhi's expertise in CVaR calculations ensures precise, data-driven insights, empowering traders and investors to manage risks with confidence.