Imagine you're a trader, sitting in front of your computer, watching the markets. You see an opportunity and decide to buy a stock at $50. But by the time your order gets executed, the price has moved to $51. That $1 difference is what traders call slippage. It might seem small, but over time, it can significantly impact your trading results. At StocksPhi, we understand the importance of managing slippage effectively to help traders achieve better outcomes.

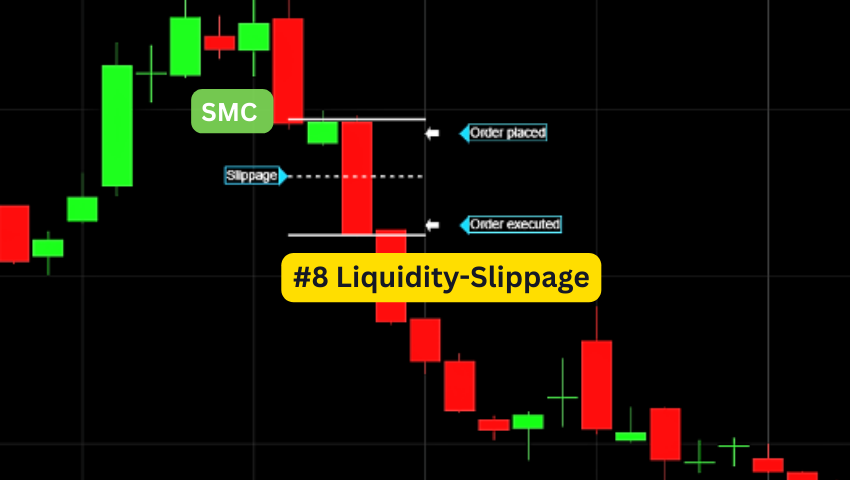

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. It typically occurs during periods of high volatility or low liquidity. For instance, if a trader places an order to buy a stock at a specific price, but the order is filled at a higher price, the difference is considered negative slippage. Conversely, if the order is filled at a lower price, it's called positive slippage.

StocksPhi offers tools and strategies designed to minimize slippage, ensuring that your trades are executed as close to your intended price as possible. Understanding the nuances of slippage can help you make more informed trading decisions and enhance your overall performance.

Slippage is influenced by several factors, each playing a crucial role in determining how much the price deviates from your expected entry or exit point. Here’s a closer look:

StocksPhi’s advanced algorithms help you navigate these challenges by analyzing market conditions in real-time and optimizing your order placement to minimize slippage.

Understanding the different types of slippage can help you develop strategies to manage it effectively.

Positive slippage occurs when an order is executed at a better price than expected. For example, if you place a buy order at $50 and it gets filled at $49.50, you've experienced positive slippage. While less common, positive slippage can be beneficial and enhance your profits.

Negative slippage happens when an order is filled at a worse price than anticipated. If you aim to buy at $50 but end up buying at $51, you face negative slippage. This is more common, especially during high volatility or low liquidity periods.

At StocksPhi, we prioritize reducing negative slippage through our state-of-the-art trading platforms and tools. Our goal is to help you achieve the best possible execution prices, enhancing your trading outcomes.

Slippage can have a significant financial impact, particularly for active traders and investors. Here are some key considerations:

StocksPhi provides detailed analytics and reporting tools to help you track and understand your slippage costs. By analyzing this data, you can refine your trading strategies and reduce the impact of slippage on your portfolio.

Slippage can vary significantly across different markets. Here’s a comparison:

At StocksPhi, we offer specialized tools tailored to each market, helping you navigate and minimize slippage regardless of the asset class you’re trading.

Choosing the right order type can significantly reduce slippage. Here are some effective options:

StocksPhi’s trading platforms support a variety of order types, allowing you to choose the one that best suits your trading strategy and risk tolerance.

Implementing best practices can help you manage and minimize slippage effectively:

StocksPhi offers real-time market data and insights to help you time your trades effectively and choose optimal trading periods.

Consider a trader who plans to buy 1,000 shares of a tech company during an earnings announcement. The expected price is $150 per share. However, due to high volatility and sudden market reactions, the order gets executed at $151. The trader experiences a negative slippage of $1 per share, resulting in an additional cost of $1,000.

In the forex market, a trader places an order to buy EUR/USD at 1.2000 before the release of major economic data from the Eurozone. The market reacts quickly to the news, and the order is filled at 1.2020. This 20-pip slippage can be substantial, especially for traders dealing in large volumes. If the trader was buying 100,000 units, the cost due to slippage would be $200.

A cryptocurrency trader decides to buy Bitcoin during a period of high market activity. The expected price is $40,000, but the order is executed at $40,500 due to the rapid price movement and low liquidity. The $500 slippage per Bitcoin significantly impacts the trader’s cost, especially if they are dealing in multiple Bitcoins.

StocksPhi provides case study analysis and historical data to help traders understand the impact of slippage in various markets. By learning from real-life examples, you can develop better strategies to manage slippage effectively.

StocksPhi offers advanced trading algorithms that help minimize slippage by optimizing order execution. These algorithms analyze market conditions in real-time and adjust order placements accordingly, ensuring you get the best possible prices.

Access to accurate and timely market data is crucial for managing slippage. StocksPhi provides real-time data feeds, allowing traders to monitor market conditions and make informed decisions. This helps in placing orders at optimal times, reducing the chances of slippage.

With StocksPhi’s trading analytics tools, you can track and analyze your trade executions to understand the impact of slippage on your performance. These insights enable you to refine your trading strategies and reduce slippage over time.

Limit orders can help you avoid unfavorable price executions by specifying the maximum or minimum price at which you’re willing to trade. While this might mean that your order doesn’t get filled immediately, it prevents unexpected slippage.

High-volatility periods often result in greater slippage. By avoiding trading during these times, such as during major news releases or right at market open and close, you can reduce the likelihood of experiencing significant slippage.

Automated trading systems can help execute trades quickly and efficiently, minimizing the delay that often leads to slippage. StocksPhi’s automated trading solutions are designed to execute orders with precision, reducing the impact of slippage.

At StocksPhi, we understand the challenges that slippage presents to traders. Our expertise in developing advanced trading tools and strategies ensures that you can navigate these challenges effectively.

Whether you’re trading stocks, forex, or cryptocurrencies, StocksPhi offers tailored solutions to address the unique challenges of each market. Our tools are designed to optimize order execution and minimize slippage across different asset classes.

We provide a wealth of educational resources, including webinars, tutorials, and articles, to help traders understand and manage slippage. Our experts share insights and strategies that you can apply to your trading practices, enhancing your ability to minimize slippage.

StocksPhi’s dedicated customer support team is always available to assist you with any questions or concerns related to slippage. Our goal is to ensure that you have the knowledge and tools necessary to manage slippage effectively.

Many traders have benefited from StocksPhi’s tools and services. For example, John, an active forex trader, shared his experience: “Using StocksPhi’s advanced algorithms, I was able to reduce my average slippage by 30%. This has significantly improved my trading results.”

In one of our success stories, a cryptocurrency trader managed to minimize slippage during a highly volatile period by using StocksPhi’s real-time market data and automated trading systems. This trader reported a 25% increase in overall profitability due to reduced slippage.

Slippage is an unavoidable aspect of trading, but with the right tools and strategies, you can minimize its impact on your trading results. StocksPhi’s comprehensive suite of solutions is designed to help you manage slippage effectively, ensuring that your trades are executed at the best possible prices.

By understanding the causes of slippage, implementing effective order types, and utilizing advanced trading tools, you can enhance your trading performance. Whether you’re trading stocks, forex, or cryptocurrencies, StocksPhi is committed to providing you with the resources and support you need to succeed.

Learn more about how StocksPhi can help you minimize slippage and improve your trading outcomes by visiting our website StocksPhi.